GST is a huge reform for indirect taxation in India, the likes of which the country has not seen post Independence. GST will simplify indirect taxation, reduce complexities, and remove the cascading effect. Experts believe that it will have a huge impact on businesses both big and small, and change the way the economy functions.

What is GST?

To understand GST, it is important that we understand the current indirect taxation system. Direct taxes such as

income tax are borne by the person liable to pay the tax; this means that the tax burden cannot be shifted to anyone else. The liability of indirect taxes, on the other hand, can be shifted to another person. So, the person liable to pay

the tax can collect the tax from someone else and then pay it to the government; thus shifting the tax burden. The GST tax

falls in this category.

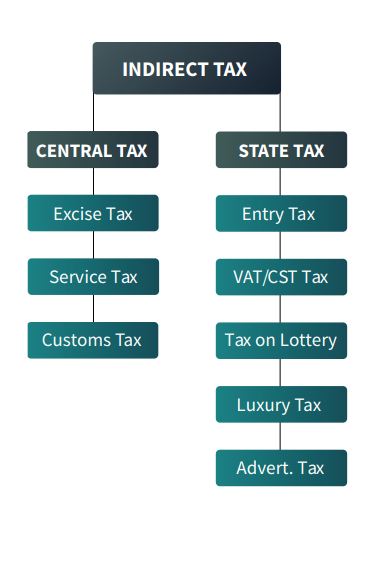

The current indirect tax structure, which comprises of so

many different taxes can be classified as:

Central taxes: levied by the Central govt (includes Central Sales Tax, Excise Duty, etc.)

State taxes: levied by the various state govt (VAT, Service

Tax, Octroi)

REGISTERING UNDER GST

Now that we know the basics of GST calculation, the process Important Points to Remember when of ITC claims and filing of returns, let us look at how a taxpayer can register for GST. If you meet any of the conditions listed below, you should obtain your GST registration when the enrollment reopens again [GST is expected to apply from 1st July 2017]:

-

Your aggregate turnover in a financial year exceeds INR 20

lakhs (INR 10 lakhs for Special category states)\

-

If your turnover includes the supply of only those goods/services

which are exempt under GST, this clause does not apply

-

To calculate this threshold, your turnover should include the aggregate value of all taxable supplies, exempt supplies, export of goods and/or services, and inter-state supplies of a person having the same PAN.

-

Every person who is registered under an earlier law will take

registration under GST too. -

Where a business that is registered has been transferred to

someone, the transferee shall take registration with effect

from the date of transfer

Exemption from GST Registration

The following shall not be required to obtain registration and will be allotted a UIN (Unique Identification Number) instead. They can receive a refund of taxes on notified supplies of goods/services received by them:

-

Any specialized agency of UNO (United Nations Organisation) or any multilateral financial institution and Organisation notified under the United Nations Act, 1947

-

Consulate or Embassy of foreign countries

-

Any other person notified by the Board/Commissioner The central government or state government may be based on the recommendation of the GST council, notify

exemption from registration to specific persons.

Input Tax Credit in Detail

When you buy a product/service from a registered dealer you pay taxes on the purchase, while making sales, tax is collected, and periodically the same is adjusted with the tax you already paid at the time of purchase and balance liability of tax (tax on sales (minus) tax on purchase) is to be paid to the

government. This mechanism is called utilization of input tax credit (tax on purchase adjustment against tax liability on output i.e. sales).

Following are some of the conditions that need to be addressed for availing ITC:

1. Input credit is to be availed within one year: Businesses

will not be entitled to take input tax credit under GST law, in

respect of any supply of goods and/ or services after the expiry of one year from the date of issue of tax invoice in respect

of such supply.

2. Generally accepted accounting principles should be

followed: The amount of credit under GST law will be calculated in accordance with generally accepted accounting

principles. Further rules in this regard are yet to be notified.

3. ITC is attributable to the purpose of business only: In

case goods and/or services supplied are used by the taxable

person partly for the purpose of any business and partly

for any other purpose, the ITC shall be restricted to the extent of the input tax as is attributable to the purpose of

business.

4. ITC is attributable to taxable supply: There can be a

business scenario when the goods and /or service are used

by the registered taxable person partly for effecting taxable

supplies and partly for the purpose of non-taxable supplies.

In such cases, input credit attributable to exempt/ non-taxable supply will not be available. However, the amount of

input tax on zero-rated supplies will be available as credit.

GST Registraiton Process

Step 1: Go to GST Portal (www.GST.Gov.in) click on services, then click on the registration tab and thereafter select New Registration.

Step 2: Enter the Follow details in Part A

-

Select the New Registration radio button

-

In the drop-down under ‘I am a’ – select Taxpayer

-

Select State and District from the drop-down

-

Enter the Name of Business and PAN of the business

-

Key in the Email Address and Mobile Number. The registered email id and mobile number will receive the OTPs.

-

Click on Proceed

Step 3: Enter the two OTPs received on the email and mobile. Click on Continue. If you have not received the OTP click on Resend OTP.

Step 4: You will receive the 15-digit Temporary Reference Number (TRN) now. This will also be sent to your email and mobile. Note down the TRN. You need to complete filling the part-B details within the next 15 days.

Step 5: Once again go to GST Portal select the New Registration tab

Step 6: Select Temporary Reference Number (TRN). Enter the TRN and the captcha code and click on Proceed.

Step 7: You will receive an OTP on the registered mobile and email. Enter the OTP and click on Proceed

Step 8: You will see that the status of the application is shown as drafts. Click on Edit Icon.

Steps to fill Part-B of GST registration application

Step 9 – Part B has 10 sections. Fill in all the details and submit appropriate documents. The Aadhaar authentication section was added and the bank account section was made non-mandatory in 2020.

Here is the list of documents you need to keep handy while applying for GST registration

-

Photographs

-

Constitution of the taxpayer

-

Proof for the place of business

-

Bank account details*

-

Verification and Aadhaar authentication, if chosen

If you want to apply for new GST Registration then contact us on 9717326393 this is paid services price is 1500 for new GST Registration

Tally Prime Basic to Advanced Complete Course with Certificate

MS Basic to Advanced Course with Certificate

Tally ERP 9 Basic to Advanced Complete Course with Certificate